Hunan Provincial Bureau of Statistics   Hunan Investigation Corps of National Bureau of Statistics

March 22, 2022

2021 is a landmark year in the history of the party and the country. Under the strong leadership of the CPC Central Committee with the Supreme Leader as the core, the whole province has conscientiously implemented the spirit of the important instructions of the General Secretary of the Supreme Leader on Hunan’s important speech, resolutely implemented the decision-making arrangements of the CPC Central Committee and the State Council and the work requirements of the provincial party committee and government, adhered to the general tone of striving for progress while maintaining stability, comprehensively implemented the new development concept, accelerated the construction of a new development pattern, and fully implemented the strategic positioning and mission of "three highs and four innovations". We made overall plans for the prevention and control of epidemic situation and economic and social development, made solid efforts in the work of "six stabilities" and "six guarantees", actively and effectively responded to various difficult challenges, made steady progress in economic operation, improved quality in stability, and achieved a harmonious and stable overall social situation, thus achieving a good start in the 14 th Five-Year Plan.

I. Synthesis

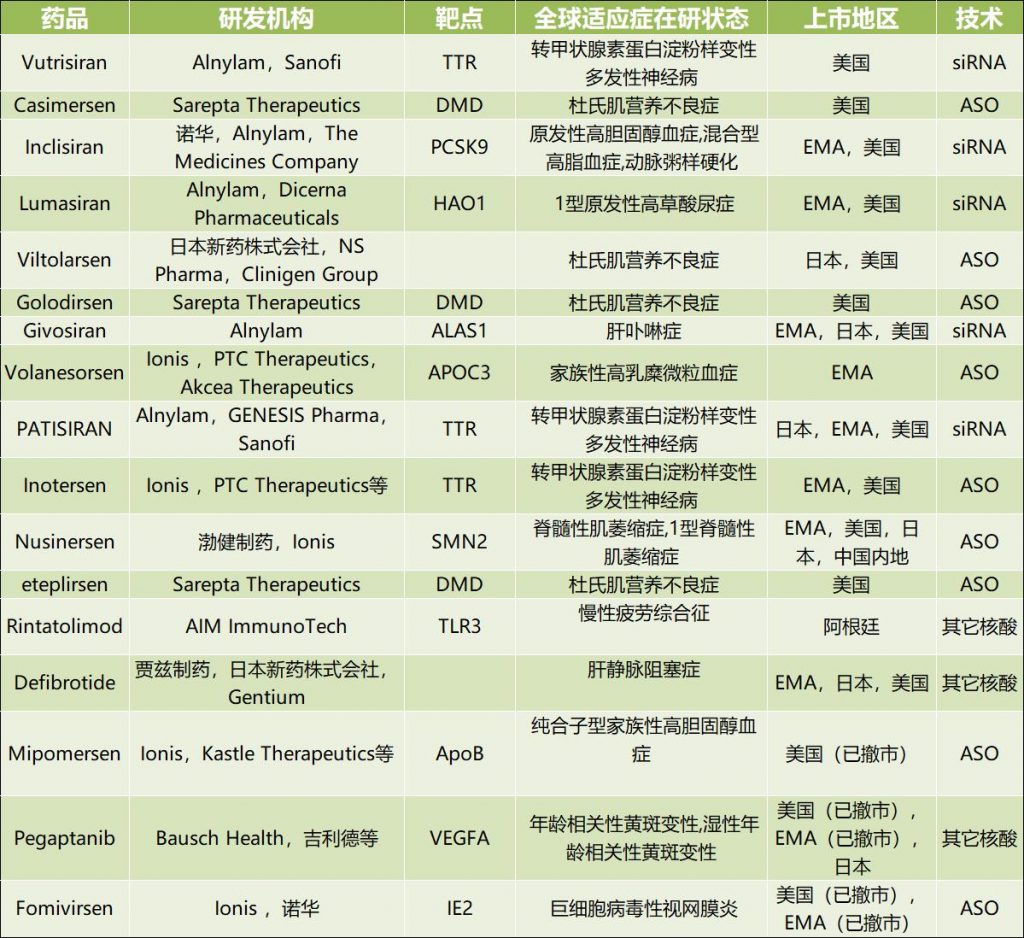

According to the unified accounting results of regional GDP, the annual regional GDP

The tertiary industrial structure is 9.4: 39.3: 51.3. The industrial added value increased by 8.3%, accounting for 30.7% of the regional GDP; The added value of high-tech industries increased by 19.0%, accounting for 23.9% of the regional GDP; The added value of strategic emerging industries increased by 12.3%, accounting for 10.3% of the regional GDP. The contribution rates of the added value of the primary, secondary and tertiary industries to economic growth are 12.4%, 34.6% and 53.0% respectively. Among them, the contribution rate of industry to economic growth is 32.3%, and the contribution rate of producer services to economic growth is 24.2%.

Regionally, Changsha-Zhuzhou-Xiangtan area

Second, agriculture

The total output value of agriculture, forestry, animal husbandry and fishery was 766.24 billion yuan, an increase of 10.4%. Among them, the agricultural output value was 353.29 billion yuan, an increase of 3.6%; The forestry output value was 45.58 billion yuan, an increase of 9.5%; The output value of animal husbandry was 254.25 billion yuan, an increase of 20.6%; The fishery output value was 57.08 billion yuan, up by 4.3%.

The annual grain planting area was 4,758.4 thousand hectares, an increase of 3.6 thousand hectares or 0.1% over the previous year. Among them, the area of summer grain is 113.9 thousand hectares, an increase of 7.6 thousand hectares or 7.1%; The area of early rice was 1,219.6 thousand hectares, a decrease of 6.1 thousand hectares or 0.5%; The area of autumn grain was 3,424.9 thousand hectares, an increase of 2.2 thousand hectares or 0.1%. Among the autumn grain areas, the area of middle rice and late rice in one season is 1479.2 thousand hectares, an increase of 3.1 thousand hectares or 0.2%; The area of double-cropping late rice was 1272.3 thousand hectares, a decrease of 19.7 thousand hectares or 1.5%. The annual grain output was 30.744 million tons, an increase of 592,000 tons or 2.0% over the previous year. Among them, the output of summer grain was 452,000 tons, an increase of 20,000 tons and an increase of 4.7%; The output of early rice was 7.438 million tons, an increase of 251,000 tons and an increase of 3.5%. The output of autumn grain was 22.854 million tons, an increase of 321,000 tons and an increase of 1.4%.

The annual cotton planting area was 60.2 thousand hectares, an increase of 1.2% over the previous year; The planting area of sugar was 7.5 thousand hectares, down by 0.8%; The oil planting area was 1479.8 thousand hectares, an increase of 1.8%; The planting area of vegetables and edible fungi was 1391.5 thousand hectares, an increase of 2.7%. Cotton output was 80,000 tons, an increase of 8.1%; 2.63 million tons of oil, an increase of 0.9%; 184,000 tons of flue-cured tobacco, an increase of 0.4%; 259,000 tons of tea, an increase of 3.4%; 42.689 million tons of vegetables and edible fungi, an increase of 3.9%.

The total output of pigs, cattle, sheep and poultry was 5.597 million tons, an increase of 23.7% over the previous year. Among them, the output of pork was 4.431 million tons, an increase of 31.2%; The beef output was 213,000 tons, an increase of 3.9%; The output of mutton was 175,000 tons, an increase of 8.7%; The output of poultry meat was 778,000 tons, down by 0.5%. At the end of the year, there were 42.02 million live pigs, an increase of 12.5% over the end of last year, among which there were 3.681 million fertile sows, an increase of 4.7%; The cattle population was 4.351 million, down by 0.7%; The number of sheep was 7.751 million, an increase of 1.8%; There were 374.561 million poultry in cages, down by 0.6%. In the whole year, 61.218 million pigs were slaughtered, an increase of 31.4% over the previous year; 1.807 million cattle were slaughtered, an increase of 3.5%; 10.641 million sheep were slaughtered, an increase of 8.2%; Poultry released 540.252 million feathers, down 0.7%. The output of poultry eggs was 1.179 million tons, down by 0.8%; The milk output was 57,000 tons, an increase of 1.8%; The output of aquatic products was 2.661 million tons, an increase of 2.8%.

In the whole year, the effective irrigation area of farmland was 21.3 thousand hectares, and the water-saving irrigation area was 27.8 thousand hectares. 166 high-standard farmland construction projects were implemented, with a construction area of 4.63 million mu. 70,000 water conservancy projects were started, with an investment of 26.71 billion yuan, and 70 million cubic meters of earth and stone were completed. Rural roads have been upgraded and rebuilt for 4510 kilometers.

III. Industry and Construction Industry

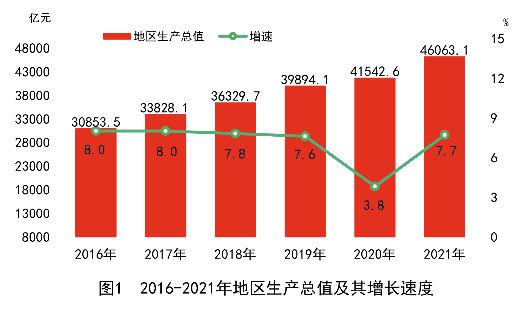

The added value of industrial enterprises above designated size increased by 8.4% over the previous year. Among them, the added value of private enterprises increased by 8.6%, accounting for 70.6% of industries above designated size. High-tech manufacturing

Among the main products of industrial statistics above designated size in the whole year, rice was 19.081 million tons, an increase of 6.2% over the previous year; Feed was 20.383 million tons, an increase of 17.6%; The processing volume of crude oil was 8.089 million tons, down by 7.9%; 104.548 million tons of cement, down 5.0%; 29.797 million tons of steel, an increase of 8.3%; Ten kinds of non-ferrous metals were 2.332 million tons, an increase of 10.1%; 37,000 sets of concrete machinery, down 6.8%; 673,000 cars, an increase of 4.9%; The power generation was 165.86 billion kWh, up by 10.1%.

Total profits of industrial enterprises above designated size

The added value of the construction industry in the whole year was 397.34 billion yuan, an increase of 2.0% over the previous year. The total profit of general contracting and professional contracting construction enterprises above qualification was 33.94 billion yuan, an increase of 1.4%. The building construction area was 763.679 million square meters, an increase of 12.3%. The completed building area was 240.291 million square meters, an increase of 13.1%.

Fourth, the service industry

The added value of wholesale and retail industry in the whole year was 456.30 billion yuan, an increase of 9.4% over the previous year; The added value of transportation, warehousing and postal services was 165.24 billion yuan, an increase of 8.0%; The added value of accommodation and catering industry was 91.35 billion yuan, an increase of 13.3%; The added value of the financial industry was 228.80 billion yuan, an increase of 4.5%; The added value of the real estate industry was 294.54 billion yuan, an increase of 2.4%; The added value of information transmission, software and information technology services was 100.07 billion yuan, an increase of 15.7%; The added value of leasing and business services was 141.45 billion yuan, up by 7.7%. The operating income of service enterprises above designated size increased by 17.6%, and the total profit increased by 41.7%.

The annual turnover of passenger and cargo transportation was 360.83 billion tons kilometers, an increase of 10.6% over the previous year. The turnover of goods was 291.59 billion tons kilometers, up by 11.3%. Among them, the railway turnover was 98.69 billion tons kilometers, an increase of 15.2%; The turnover of highways was 146.12 billion tons kilometers, an increase of 8.2%. Passenger turnover was 101.33 billion person-kilometers, an increase of 3.4%. Among them, the railway turnover was 66.06 billion person-kilometers, up by 8.7%; Highway turnover was 19.54 billion person-kilometers, down by 13.1%; The turnover of civil aviation was 15.57 billion person-kilometers, an increase of 6.9%.

At the end of the year, the mileage of highways was 241,900 kilometers, an increase of 0.3% over the end of last year. Among them, the expressway mileage was 7083 kilometers, an increase of 132 kilometers over the end of last year. The operating mileage of the railway was 5,909 kilometers, an increase of 4.7%. Among them, the high-speed railway is 2250 kilometers, an increase of 254 kilometers. The number of civilian vehicles was 10.35 million, an increase of 8.2%. Among them, the number of private cars was 9.638 million, an increase of 8.3%. The number of cars was 5.673 million, an increase of 8.6%.

Total business volume of postal industry in the whole year

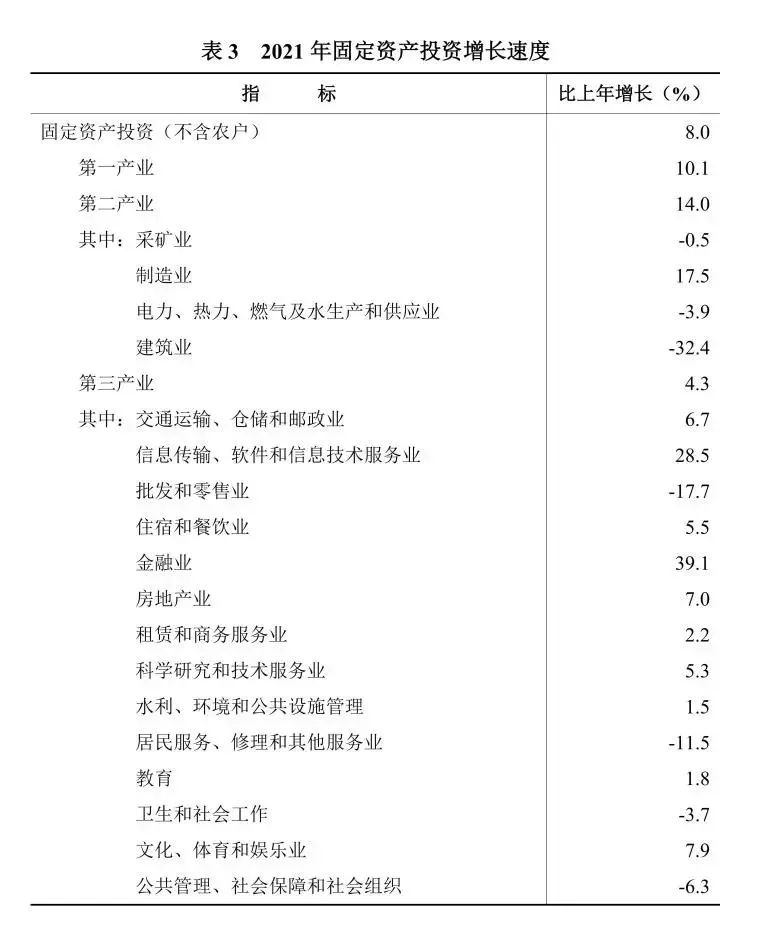

V. Investment in fixed assets

Annual investment in fixed assets (excluding farmers) increased by 8.0% over the previous year. Among them, private investment increased by 9.6%. In terms of economic types, state-owned investment decreased by 5.1% and non-state-owned investment increased by 12.9%. In terms of investment direction, investment in people’s livelihood projects decreased by 3.8%, investment in ecological environment increased by 3.9%, investment in infrastructure increased by 3.6%, and investment in high-tech industries.

The investment in real estate development in the whole year was 542.78 billion yuan, an increase of 11.2% over the previous year. Among them, residential investment was 416.46 billion yuan, an increase of 15.2%. The sales area of commercial housing was 91.888 million square meters, down by 2.6%. Among them, the residential sales area was 83.167 million square meters, down 2.2%. The sales of commercial housing was 604.05 billion yuan, up by 1.6%. Among them, residential sales reached 539.04 billion yuan, an increase of 3.2%. At the end of the year, the area of commercial housing for sale was 11.463 million square meters, a decrease of 1.875 million square meters or 14.1% from the end of the previous year.

VI. Domestic Trade and Prices

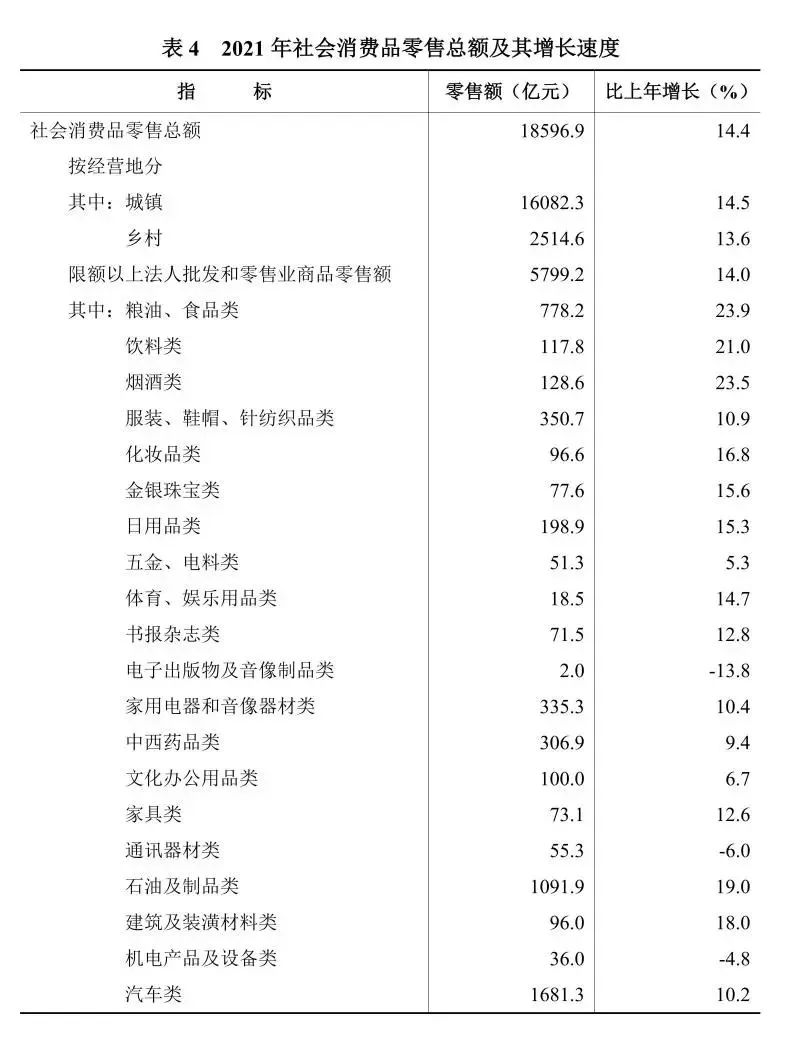

The total retail sales of consumer goods in the whole year was 1,859.69 billion yuan, an increase of 14.4% over the previous year. In terms of business locations, the retail sales of urban consumer goods was 1,608.23 billion yuan, an increase of 14.5%; The retail sales of rural consumer goods reached 251.46 billion yuan, an increase of 13.6%. In terms of consumption types, the retail sales of commodities was 1,632.60 billion yuan, an increase of 13.6%; The catering revenue was 227.08 billion yuan, an increase of 20.6%. In terms of regions, the total retail sales of social consumer goods in Changsha, Zhuzhou and Xiangtan area was 722.84 billion yuan, an increase of 14.5%; The total retail sales of social consumer goods in southern Hunan was 376.84 billion yuan, an increase of 14.2%; The total retail sales of social consumer goods in western Hunan was 333.89 billion yuan, an increase of 13.8%; The total retail sales of social consumer goods in Dongting Lake area was 426.10 billion yuan, up by 14.8%.

The retail sales of wholesale and retail commodities above designated size reached 579.92 billion yuan, an increase of 14.0% over the previous year. In terms of commodity categories, the retail sales of grain, oil and food increased by 23.9%, cosmetics by 16.8%, household appliances and audio-visual equipment by 10.4%, Chinese and western medicines by 9.4%, communication equipment by 6.0%, petroleum and products by 19.0% and automobiles by 10.2%. Among green smart goods, the retail sales of wearable smart devices increased by 18.5%, smartphones increased by 17.6%, and new energy vehicles increased by 61.9%.

The annual online retail sales of physical goods reached 175.52 billion yuan, an increase of 12.1% over the previous year, accounting for 9.4% of the total retail sales of social consumer goods.

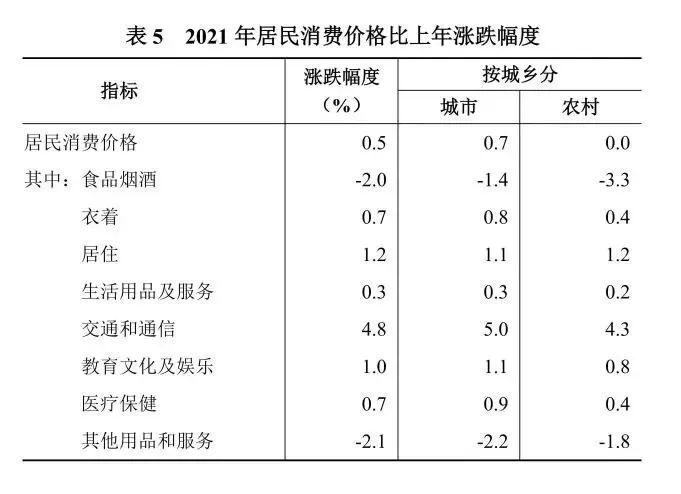

The annual consumer price rose by 0.5% over the previous year. Among them, cities rose by 0.7%, and rural areas were flat with the previous year. The retail price of commodities rose by 1.6%. The ex-factory price of industrial producers rose by 5.9%, and the purchase price of industrial producers rose by 8.1%. Producer prices of agricultural products fell by 9.9%.

VII. Foreign Economy

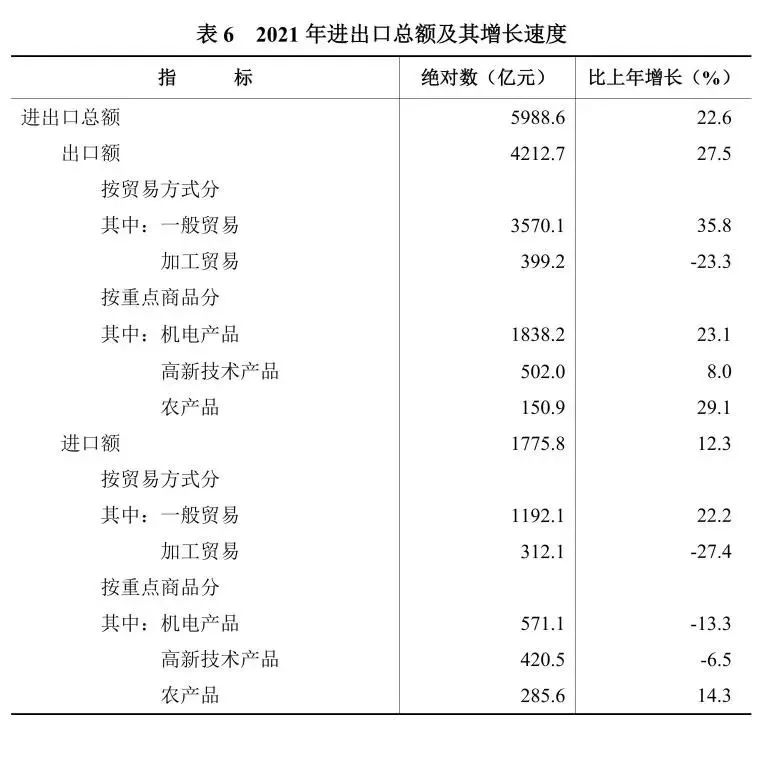

Total annual import and export volume

The actual use of foreign direct investment in the whole year was 2.41 billion US dollars, an increase of 72.3% over the previous year. Among them, the primary industry was $0.3 billion, an increase of 883.0%; The secondary industry was $370 million, down by 13.8%; The tertiary industry was US$ 2.02 billion, up by 108.6%. Six new Fortune 500 companies were introduced. In fact, the domestic and foreign funds in place were 1,128.03 billion yuan, an increase of 29.1%. Among them, the primary industry was 65.18 billion yuan, down 5.3%; The secondary industry was 535.72 billion yuan, an increase of 31.4%; The tertiary industry was 527.14 billion yuan, an increase of 32.7%. The contract signed 1035 major projects with a total investment of over 200 million yuan (US$ 30 million).

In the whole year, the newly signed contracts for foreign contracted projects amounted to 5.56 billion US dollars, an increase of 24.6% over the previous year; Realized a turnover of $2.76 billion, an increase of 22.5%; 7,700 laborers of various types were dispatched, an increase of 40.0%. Foreign direct investment increased Chinese contract value by 820 million US dollars, down by 62.4%. The actual amount of foreign direct investment was US$ 1.67 billion, up by 12.1%.

VIII. Finance and finance

The local general public budget revenue for the whole year was 325.07 billion yuan, an increase of 8.0% over the previous year. Among them, the tax revenue was 224.60 billion yuan, an increase of 9.1%; Non-tax revenue was 100.47 billion yuan, an increase of 5.7%. Among the tax revenue, the domestic value-added tax was 78.42 billion yuan, an increase of 11.9%; Enterprise income tax was 27.10 billion yuan, up by 5.9%. The general public budget expenditure was 836.48 billion yuan, an increase of 3.4%. Among them, education expenditure was 138.99 billion yuan, an increase of 4.9%; Expenditure on social security and employment was 134.51 billion yuan, an increase of 3.4%; Health expenditure was 77.54 billion yuan, an increase of 6.6%; Expenditure on science and technology was 22.10 billion yuan, an increase of 5.6%; Expenditure on housing security was 24.04 billion yuan, up by 1.1%.

At the end of the year, the balance of local and foreign currency deposits of financial institutions was 6,289.10 billion yuan, an increase of 8.6% over the end of the previous year. Among them, the balance of household deposits was 3,553.14 billion yuan, an increase of 11.5%; The balance of deposits of non-financial enterprises was 1,381.82 billion yuan, an increase of 2.7%. The balance of local and foreign currency loans was 5,584.50 billion yuan, up by 13.0%. Among them, the balance of household loans was 2,077.65 billion yuan, an increase of 13.0%; The loan balance of non-financial enterprises and government organizations was 3,495.03 billion yuan, an increase of 12.9%.

At the end of the year, there were 132 listed companies in the province, with a total direct financing of 519.38 billion yuan, an increase of 11.1% over the previous year. At the end of the year, the total market value of A-share listed companies was 1,994.40 billion yuan, an increase of 13.8%. At the end of the year, there were 439 business departments of securities companies, an increase of 3; The annual securities transaction volume was 12,172.79 billion yuan, an increase of 71.0%. At the end of the year, there were 2 futures companies in the jurisdiction, a year-on-year decrease of 1; The annual turnover was 7,138.41 billion yuan, an increase of 21.7%.

In the whole year, the original insurance premium income of insurance companies was 150.88 billion yuan, an increase of 4.8% over the previous year. Among them, life insurance premium income was 74.85 billion yuan, an increase of 6.2%; Health insurance premium income was 32.83 billion yuan, an increase of 12.6%; Personal accident insurance premium income was 4.07 billion yuan, an increase of 4.9%; Property insurance premium income was 39.12 billion yuan, down 3.2%. The original insurance payment expenditure was 52.89 billion yuan, an increase of 11.3%.

IX. Education, Science and Technology

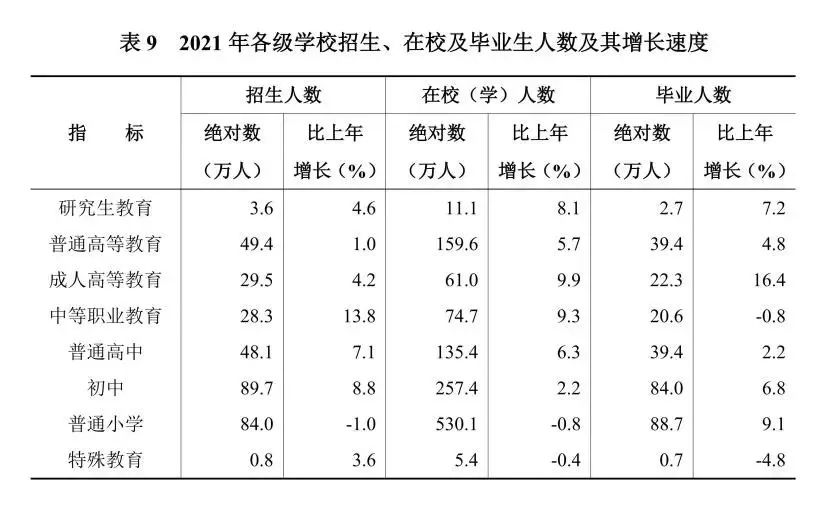

At the end of the year, there were 114 colleges and universities. There are 27,000 graduates of postgraduate education, 394,000 graduates of ordinary higher education, 206,000 graduates of secondary vocational education, 394,000 graduates of ordinary high schools, 840,000 graduates of junior high schools and 887,000 graduates of ordinary primary schools. There were 2.294 million children in the park, down 0.9% from the previous year. Enrolment rate of primary school-age children

At the end of the year, there were 11 national engineering research centers (engineering laboratories) and 331 provincial engineering research centers (engineering laboratories). There are 38 national and local joint engineering research centers (engineering laboratories). There are 65 enterprise technology centers recognized by the state. There are 14 national engineering technology research centers and 452 provincial engineering technology research centers. There are 19 national key laboratories and 339 provincial key laboratories. 17,721 technical contracts were signed, with a turnover of 126.13 billion yuan. 929 scientific and technological achievements were registered. The number of patents granted was 98,936, up by 25.7%. Among them, 16,564 invention patents were granted, an increase of 43.6%. The number of patents granted by industrial and mining enterprises, universities and scientific research units is 60457, 14785 and 746 respectively.

At the end of the year, there were 2041 inspection and testing institutions. Among them, there are 24 national product quality supervision and inspection centers. There are 103 legal metrological verification institutions. There are 1,860 special equipment production units and 474,000 special equipment. The qualified rate of supervision and spot check of key industrial products is 87.6%. Participated in the formulation of 7 international standards, 210 national standards and 329 local standards. 1,526 maps were published publicly, with 376,000 map users’ visits and 1.794 million geospatial data achievements.

X. Culture, Health and Sports

By the end of the year, there were 631 performing arts groups, 146 mass art museums and cultural centers, 143 public libraries and 122 museums and memorial halls. There are 108 radio and television stations (broadcasters). There are 5.485 million cable TV users. The comprehensive population coverage rate of broadcasting is 99.42%, and that of television is 99.80%. There are 118 national intangible cultural heritage protection catalogues and 324 provincial intangible cultural heritage protection catalogues. There are 11,605 kinds of books, 254 kinds of periodicals and 45 kinds of newspapers. The total print runs of books, periodicals and newspapers are 510 million, 90 million and 670 million respectively.

At the end of the year, there were 55,682 health institutions. Among them, there are 1,716 hospitals, 136 maternal and child health centers (institutes and stations), 78 specialized disease prevention hospitals (institutes and stations), 2,099 township health centers, 970 community health service centers (stations), 12,200 clinics, health centers and medical offices, and 37,082 village clinics. There were 506,000 health technicians, an increase of 1.1% over the previous year. Among them, there are 192,000 practicing doctors and assistant practicing doctors and 239,000 registered nurses. The hospital has 390,000 beds, an increase of 3.6%; Township hospitals have 106,000 beds, a decrease of 1.0%.

The number of people who regularly take part in physical exercise in the province is 26.66 million, and 1577 national fitness programs have been carried out. There are 1025 new administrative villages for farmers’ physical fitness projects. Won 67 national championships throughout the year. There are 159,267 sports venues. Among them, there are 263 gymnasiums, 6,859 sports grounds, 1,001 swimming pools and 7,934 training rooms.

XI. Population, Residents’ Income, Consumption and Social Security

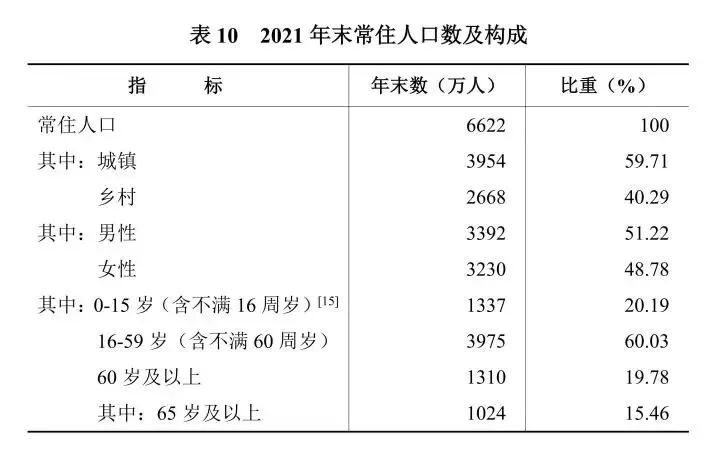

At the end of the year, the resident population of the province was 66.22 million. Among them, the urban population was 39.54 million, and the urbanization rate was 59.71%, an increase of 0.95 percentage points over the end of last year. The annual birth population was 473,000, with a birth rate of 7.13 ‰; The death population was 549,300, with a mortality rate of 8.28 ‰; The natural population growth rate is -1.15‰. The proportion of the population aged 0-15 (including those under 16) to the resident population was 20.19%, down by 0.56 percentage points; The proportion of people aged 16-59 (including those under 60) was 60.03%, an increase of 0.65 percentage points; The proportion of people aged 60 and over was 19.78%, down by 0.10 percentage points.

In the whole year, the per capita disposable income of residents in the province was 31,993 yuan, an increase of 8.9% over the previous year; The median per capita disposable income was 25,834 yuan, an increase of 8.6%. According to the place of permanent residence, the per capita disposable income of urban residents was 44,866 yuan, an increase of 7.6%; The median per capita disposable income of urban residents was 40,177 yuan, an increase of 7.2%. The per capita disposable income of rural residents was 18,295 yuan, an increase of 10.3%; The median per capita disposable income of rural residents was 16,496 yuan, an increase of 11.2%. The ratio of urban and rural per capita disposable income decreased from 2.51 in the previous year to 2.45. In terms of regions, the per capita disposable income of residents in Changsha, Zhuzhou and Xiangtan was 48,924 yuan, an increase of 8.1%; The per capita disposable income of residents in southern Hunan was 29,543 yuan, an increase of 8.7%; The per capita disposable income of residents in western Hunan was 22,190 yuan, an increase of 9.2%; The per capita disposable income of residents in Dongting Lake area was 29,165 yuan, an increase of 9.3%. Poverty alleviation county

In the whole year, the per capita consumption expenditure of residents in the province was 22,798 yuan, an increase of 8.6% over the previous year. According to the place of permanent residence, the per capita consumption expenditure of urban residents was 28,294 yuan, an increase of 5.6%; The per capita consumption expenditure of rural residents was 16,951 yuan, an increase of 13.2%.

In the whole year, 753,000 people were newly employed in cities and towns. At the end of the year, the number of people participating in the basic old-age insurance for urban and rural residents was 34.436 million, down by 0.8%. The number of people participating in the basic old-age insurance for urban workers was 18.495 million, an increase of 6.9%. Among them, there are 11.414 million employees and 4.276 million retirees. The number of people participating in basic medical insurance is 67.487 million. Among them, 57.235 million people participated in the basic medical insurance for urban and rural residents and 10.252 million people participated in the basic medical insurance for urban workers. The number of employees participating in unemployment insurance was 6.874 million, an increase of 7.3%. The number of employees participating in industrial injury insurance was 8.533 million. The number of employees participating in maternity insurance was 6.528 million. At the end of the year, the number of employees receiving unemployment insurance was 172,000. 390,000 urban residents received the government’s minimum living guarantee, and the minimum living guarantee fund was 2.10 billion yuan; 1.453 million rural residents received the government’s minimum living security, and 4.72 billion yuan of minimum living security funds were distributed. At the end of the year, 278,000 beds were provided for residential civil administration institutions, and 124,000 people were adopted. Among them, there are 262,000 beds in the old-age care institutions and 116,000 people in the old-age care institutions. There are 32,000 community service institutions and facilities. In the whole year, we sold 5.14 billion yuan of social welfare lottery tickets and raised 1.67 billion yuan of welfare lottery funds. Successfully completed 20 key livelihood issues. Among them, 101 Furong schools were built, and 135,000 public kindergarten places were added.61,200 legal aid cases were handled, and 1.562 million vocational skills trainings were subsidized by the government.

XII. Resources, Environment and Safety in Production

146 kinds of minerals have been discovered and 111 kinds of minerals with proven resource reserves have been discovered in the province. Among them, there are 7 kinds of energy minerals, 39 kinds of metal minerals, 63 kinds of non-metal minerals and 2 kinds of water and gas minerals. 119 geological exploration projects (including continuation projects) were funded by the government, and 9 large and medium-sized mineral areas were newly discovered.

In the whole year, the proportion of water quality sections meeting or better than Class III standards was 96.1%, an increase of 0.2 percentage points over the previous year. The air quality of six municipal cities reached the second-class standard. The treatment rate of municipal domestic sewage is 97.95%, and the harmless treatment rate of municipal domestic garbage is 100%. There are 53 nature reserves at or above the provincial level, covering an area of 910,000 hectares. Among them, 23 are national and 30 are provincial. There are 71 scenic spots above the provincial level, covering an area of 741,000 hectares. Among them, 22 are national and 49 are provincial. There are 2 world geoparks and 14 national geoparks. The afforestation area was 425,000 hectares. At the end of the year, the forest land area was 12.736 million hectares, the standing trees accumulated 641 million cubic meters, and the forest coverage rate was 59.97%.

According to preliminary accounting, the comprehensive energy consumption of industrial enterprises above designated size increased by 5.3% over the previous year. Among them, the comprehensive energy consumption of six high energy-consuming industries increased by 6.5%.

In the whole year, there were 1484 production and operation safety accidents and 1579 deaths. There were 0.03 deaths in accidents with a GDP of 100 million yuan, and 0.003 deaths in coal mines with a million tons. The death rate of road traffic accidents was 3.34 people/10,000 vehicles, down by 0.38 people/10,000 vehicles.

Notes:

[1] The data in this bulletin are all preliminary statistics, and some data are not equal to the total of sub-items due to rounding.

[2] The absolute figures of regional GDP, added value of tertiary industries and related industries and per capita regional GDP are calculated at current prices, and the growth rate is calculated at constant prices.

[3] Changsha-Zhuzhou-Xiangtan region refers to Changsha, Zhuzhou and Xiangtan, southern Hunan refers to Hengyang, Chenzhou and Yongzhou, western Hunan refers to Shaoyang, Zhangjiajie, Huaihua, Loudi and Xiangxi Autonomous Prefecture, and Dongting Lake refers to Yueyang, Changde and Yiyang.

[4] High-tech manufacturing includes pharmaceutical manufacturing, aviation, spacecraft and equipment manufacturing, electronic and communication equipment manufacturing, computer and office equipment manufacturing, medical equipment and instrumentation manufacturing, and information chemicals manufacturing.

[5] Equipment manufacturing industry mainly includes metal products industry, general equipment manufacturing industry, special equipment manufacturing industry, automobile manufacturing industry, railway, ship, aerospace and other transportation equipment manufacturing industry, electrical machinery and equipment manufacturing industry, computer, communication and other electronic equipment manufacturing industry, and instrument manufacturing industry.

[6] The output data of some products in 2020 were verified and adjusted, and the output growth rate in 2021 was calculated according to comparable caliber.

[7] Due to the adjustment of the caliber stipulated in the statistical investigation system, statistical law enforcement, elimination of duplicate data and other factors, the growth rate and change of financial indicators of industrial enterprises above designated size in 2021 are calculated according to the comparable caliber.

[8] The total business volume of postal industry is calculated at the price of 2020.

[9] The total telecom business is calculated at the price of 2020.

[10] High-tech industry investment includes six categories of high-tech manufacturing investment and information services, e-commerce services, inspection and testing services, high-tech services in professional and technical services, R&D and design services, scientific and technological achievements transformation services, intellectual property rights and related legal services, environmental monitoring and governance services and other high-tech services, including pharmaceutical manufacturing, aviation, spacecraft and equipment manufacturing, electronic and communication equipment manufacturing, computer and office equipment manufacturing, medical equipment and instrumentation manufacturing.

[11] According to relevant regulations, foreign trade is denominated in RMB.

[12] The import and export amount of goods to the EU does not include the data of Britain, and the growth rate is calculated according to the comparable caliber.

[13] The enrollment rate of primary school-age children refers to the percentage of school-age children who have entered primary school within the scope of investigation to the total number of school-age children inside and outside the school.

[14] The gross enrollment rate of high school education mainly reflects the coverage of high school education, which means that the total number of students in high school accounts for the percentage of the school-age population aged 15-17.

[15] By the end of 2021, the population of the province aged 0-14 (including those under 15 years old) was 12.49 million, and the population aged 15-59 (including those under 60 years old) was 40.63 million.

[16] Poverty-stricken counties in Hunan Province, that is, the original poverty-stricken areas in Hunan, including the original concentrated contiguous poverty-stricken areas and the original national poverty alleviation and development key counties outside the area, have a total of 40 counties. Among them, the concentrated contiguous poverty-stricken areas cover 37 counties, and there are 20 national poverty alleviation and development key counties, and the concentrated contiguous poverty-stricken areas include 17 national poverty alleviation and development key counties.